Real Estate Investment Tips sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

Real estate investment has long been a go-to choice for savvy investors looking to grow their wealth. From residential properties to commercial spaces, the world of real estate offers a wealth of opportunities for those willing to dive in and learn the ropes. Let’s explore some key tips and tricks to help you navigate this dynamic market with confidence.

Importance of Real Estate Investment

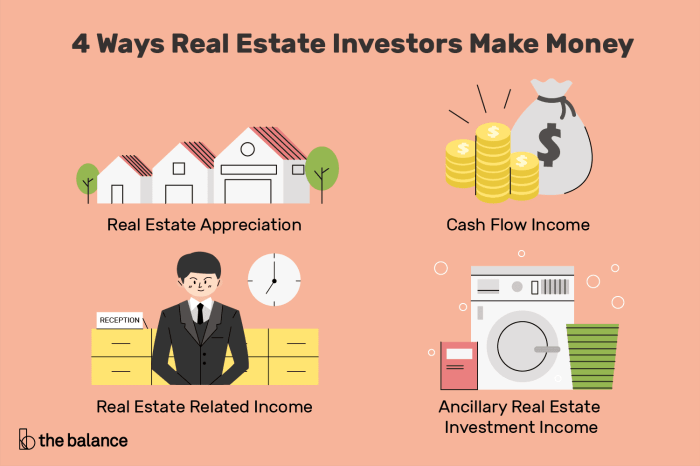

Real estate investment is a popular choice for many investors due to its potential for long-term financial growth and stability. Unlike other investment options, real estate offers tangible assets that can provide a steady income stream through rental payments and appreciation in property value over time.

Benefits of Investing in Real Estate

- Income Generation: Real estate investments can provide a consistent source of passive income through rental payments from tenants.

- Appreciation: Properties have the potential to increase in value over time, allowing investors to build wealth through capital gains.

- Diversification: Real estate can act as a hedge against stock market volatility, providing a stable investment option for a balanced portfolio.

- Tax Advantages: Investors can benefit from tax deductions on mortgage interest, property taxes, depreciation, and other expenses related to owning real estate.

Successful Real Estate Investment Stories

“I bought a fixer-upper property in an up-and-coming neighborhood and renovated it to attract higher-paying tenants. Within a few years, the property’s value had doubled, and I was able to sell it for a substantial profit.”

“I invested in a commercial property in a prime location and secured long-term leases with reputable tenants. The steady rental income allowed me to reinvest in more properties and grow my real estate portfolio significantly.”

Types of Real Estate Investments: Real Estate Investment Tips

Investing in real estate offers various opportunities for investors to diversify their portfolios and generate passive income. Different types of real estate investments include residential, commercial, industrial, and land. Each type comes with its own set of risks and rewards, making it essential for investors to understand the differences before deciding where to invest their money.

Residential Real Estate

Residential real estate involves properties such as single-family homes, condos, townhouses, and apartment buildings. Investors can generate rental income from tenants or earn profits through property appreciation. However, the risks include vacancies, property damage, and market fluctuations.

Commercial Real Estate

Commercial real estate includes office buildings, retail spaces, warehouses, and hotels. Investors can benefit from long-term leases and potentially higher rental income compared to residential properties. The risks involve economic downturns, tenant turnover, and property maintenance costs.

Industrial Real Estate

Industrial real estate comprises properties like manufacturing facilities, distribution centers, and storage units. Investors can capitalize on the growing demand for industrial space driven by e-commerce and logistics. Risks include environmental regulations, technological advancements, and changes in supply chain dynamics.

Land Investments

Land investments involve buying undeveloped or underdeveloped land for future use or resale. Investors can benefit from property appreciation, rezoning opportunities, and development potential. However, risks include zoning restrictions, market uncertainties, and holding costs.

Overall, the type of real estate investment suitable for investors depends on their financial goals, risk tolerance, and investment horizon. It is crucial to conduct thorough research and seek guidance from real estate professionals to make informed decisions and maximize returns in the ever-evolving real estate market.

Factors to Consider Before Investing

When diving into real estate investment, there are several crucial factors that investors should carefully consider to make informed decisions and maximize their returns.

Importance of Location

One of the key factors to consider before investing in real estate is the location of the property. A prime location can significantly impact the value and demand for the property, leading to higher returns on investment.

Market Trends Analysis

It is essential to conduct thorough market research and analyze current and future trends in the real estate market. Understanding market dynamics can help investors predict potential growth and make strategic investment decisions.

Property Condition Assessment

Before investing in a property, it is crucial to assess the condition of the property. Consider factors like the age of the property, maintenance requirements, and potential renovation costs to estimate the overall investment needed.

Potential for Growth Evaluation

Investors should evaluate the potential for growth of the property in terms of appreciation, rental income, and overall profitability. By forecasting the future performance of the property, investors can make informed decisions that align with their investment goals.

Financing Real Estate Investments

Investing in real estate can be a lucrative venture, but it often requires significant capital upfront. Understanding the various financing options available is crucial for success in this field.

Traditional Mortgages

- Traditional mortgages are a common way to finance real estate investments, where a lender provides funds to purchase a property in exchange for monthly payments with interest.

- Pros: Lower interest rates, longer repayment terms, and easier qualification criteria compared to other financing options.

- Cons: Strict requirements, such as a good credit score and stable income, may limit access for some investors.

Hard Money Loans

- Hard money loans are short-term, high-interest loans secured by the property itself, making them ideal for investors who need quick access to funds.

- Pros: Fast approval process, flexible terms, and less stringent credit requirements compared to traditional mortgages.

- Cons: Higher interest rates, shorter repayment periods, and potential for higher overall costs due to fees.

Partnerships

- Forming partnerships with other investors or real estate professionals can be a viable option to pool resources and share the financial burden of investments.

- Pros: Access to larger capital, shared risks, and expertise from partners with different skills and knowledge.

- Cons: Potential for conflicts, disagreements over decision-making, and profit-sharing arrangements.

Leveraging Debt for Real Estate Investments, Real Estate Investment Tips

- Using debt to finance real estate investments can amplify returns through leverage, but it also increases risk exposure.

-

Leverage Ratio = Total Debt / Total Equity

- Pros: Higher potential returns, increased purchasing power, and tax advantages through deductible interest payments.

- Cons: Greater financial risk, cash flow constraints, and vulnerability to market fluctuations or economic downturns.

Securing Financing for Real Estate Investments

- For beginners, building good credit, saving for a down payment, and establishing relationships with lenders are essential steps to secure financing.

- Seeking pre-approval, comparing loan offers, and working with a real estate agent experienced in investment properties can also improve chances of securing financing.